Private investors for real estate loans

Lately, Reel Property Solutions, LLC has been seeking private investors for real estate loans to aid in purchasing, rehabbing, and reselling more properties. People with private money do NOT necessarily have to be another real estate investor, nor someone who is wealthy. Some examples of how people typically invest their money: savings account, Certificate of Deposit (CD), retirement account, Stock Market, savings bond, and other ways specific to a person’s unique situation. Below summarizes how these forms of investments bring a tiny fraction of a return as compare to how someone will benefit as private investors for real estate loans:

Lately, Reel Property Solutions, LLC has been seeking private investors for real estate loans to aid in purchasing, rehabbing, and reselling more properties. People with private money do NOT necessarily have to be another real estate investor, nor someone who is wealthy. Some examples of how people typically invest their money: savings account, Certificate of Deposit (CD), retirement account, Stock Market, savings bond, and other ways specific to a person’s unique situation. Below summarizes how these forms of investments bring a tiny fraction of a return as compare to how someone will benefit as private investors for real estate loans:

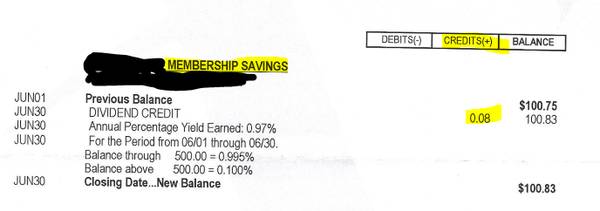

This is OUR ACTUAL SAVINGS ACCOUNT (opened in September 2016 with $100, as of June 30, 2017 has $100.83):

*Very tiny return

*Cannot do hardly anything with the returned rate due to lack of funds

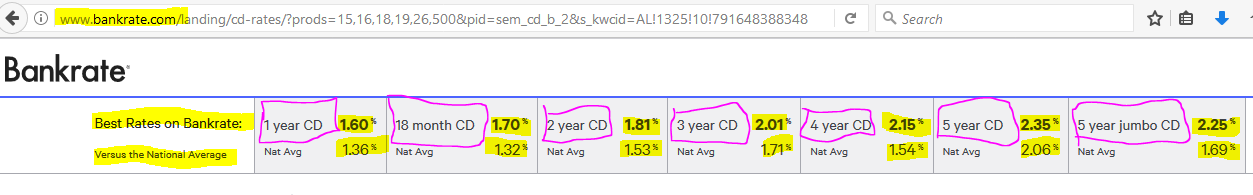

Do you put your $$$$ into a Certificate of Deposit (CD) to realize the rate of return is P-A-T-H-E-T-I-C??????? See the picture from www.bankrate.com (This information was collected on July 25, 2017). You put in a hard day’s work, to get back a PITIFUL return of 1+% or MAYBE 2.36%…..?????….. that does NOT seem fair!

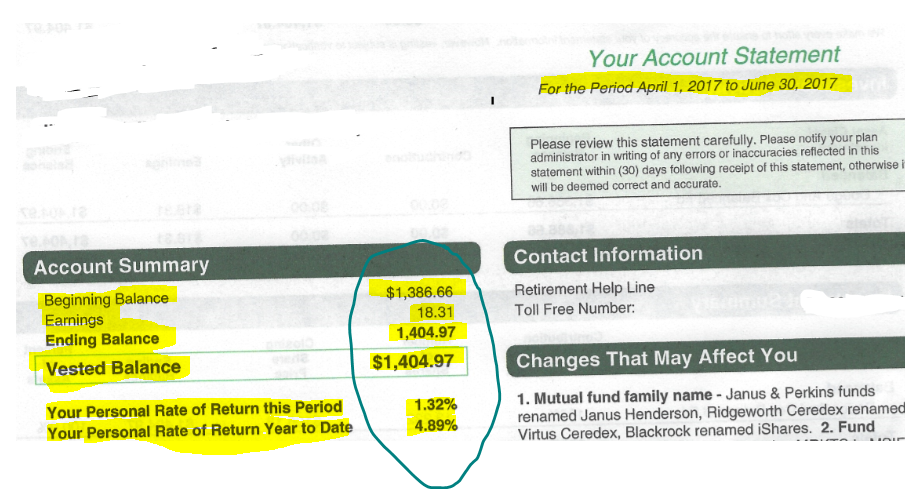

Does your retirement account look something like this??? Earning ZILCH over a 3-month time span? This is MY actual retirement account from my W2 employer! Sad, sad, sad….

The Stock Market is a complex thing. It rises. It falls. Bull Market. Bear Market. Sometimes you win. Sometimes you lose.

This is an excerpt from https://www.thebalance.com/stock-market-returns-by-year-2388543 (Information collected August 2, 2017)

“Historical S&P 500 Index Stock Market Returns

Year Return

1986 18.5%

1987 5.2%

1988 16.8%

1989 31.5%

1990 -3.1%

1991 30.5%

1992 7.6%

1993 10.1%

1994 1.3%

1995 37.6%

1996 23.1%

1997 33.4%

1998 28.6%

1999 21.0%

2000 -9.1%

2001 -11.9%

2002 -22.1%

2003 28.7%

2004 10.9%

2005 4.9%

2006 15.8%

2007 5.5%

2008 -37.0%

2009 26.5%

2010 15.1%

2011 2.1%

2012 16.0%

2013 32.4%

2014 13.7%

2015 1.4%

2016 11.9%

*Market return data from Dimensional’s Matrix Book 2016 and DFA Returns 2.0 Software program.”

What’s worse than the Stock Market ONLY gaining 2.1% in 2011? What about after the Bubble Burst in 2007 that caused the Stock Market to downfall at -37.0% in 2008? NEGATIVE PERCENTS MEANS NEGATIVE EARNINGS!

Did you get a savings bond as a gift? Was this a BIG DEAL since the bond was supposed to be an INVESTMENT to your future?? Here’s information about what a savings bond investment brings to you (collected on August 7, 2017) from https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_iratesandterms.htm

“What interest will I get if I buy an I bond now?

The composite rate for I bonds issued from May 1, 2017, through October 31, 2017, is 1.96%. This rate applies for the first six months you own the bond.

How do I bonds earn interest?

An I bond earns interest monthly from the first day of the month in the issue date. The interest accrues (is added to the bond) for up to 30 years.

The interest is compounded semiannually. Every six months from the bond’s issue date, all interest the bond has earned in previous months is in the bond’s new principal value. Interest is earned on the new principal for the next six months. For example, in month seven, interest is earned on the original price plus six months of interest. In month 13, interest is earned on the original price plus 12 months of interest. (However, values displayed by the Savings Bond Calculator for bonds that are less than five years old do not include the latest three months of interest. These values reflect the interest penalty.) If you hold the bond for at least five years, when you cash in (redeem) the bond, you receive all the interest the bond has earned plus the amount you paid for the bond.

You can redeem the bond after 12 months. However, if you redeem the bond before it is five years old, you lose the last three months of interest.”

To reiterate that in 6 months’ time, the interest rate is 1.96%. Then if you decide to cash in the bond in less than 5 years after receiving, you are penalized by not earning 3 months of interest!

Here are examples of what happens when INVESTING MONEY as private investors for real estate loans with Reel Property Solutions, LLC:

*LARGE return (12% OR MORE, depending on situation)

*Able to have funds to REINVEST

*Reel Property Solutions, LLC are REAL people who can work out a payment schedule to repay funds

*Real Estate is a HOT market in Rochester

*Your money is backed by PROPERTY that you can see, feel, hear, touch, and smell! This indeed a TANGIBLE investment!

We understand you may be asking yourself these questions:

1) What happens when a Certificate of Deposit fails to perform?

The owner (for example, YOU) lose that money. BOOOO!

2) What happens when a piece of real estate fails to perform?

Yes, this does happen…

HOWEVER………

with Reel Property Solutions, LLC, we are receiving CONTINUOUS training through a remarkable business system, Fortune Builders, that has endless tools, online education classes, live classes, webinars, field experts for advice, guidance, answers questions, plus a Facebook group to reach out for emotional support, more questions, answers, advice, etc.

THEN on top of that, Reel Property Solutions, LLC has established a wonderful network of other professionals such as real estate agents, contractors, real estate attorney, financial advisors, and the list goes on and on and on…. Reel Property Solutions, LLC does any transaction with consultations from one or more professional from our vast network.

Therefore, the risk is low. The reward is HIGH because Reel Property Solutions, LLC will have:

*LEGAL DOCUMENTS to structure how your money will be used

*REAL ESTATE ATTORNEY or REAL ESTATE AGENT for the property transaction

*LEGAL DOCUMENTS FOR CONTRACTORS to ensure all work will be completed properly

*ESTIMATED TIMELINE of how the property is being renovated so you will know exactly how your money will be used

*RESPECT TO EVERYONE!

INVEST INTO SOMETHING STABLE, SOMETHING TANGIBLE, SOMETHING THAT YOU CAN ACTUALLY PUT YOUR HANDS ON!

You can earn 1.96% on a savings bond in 6 months….

OR…..

You can earn 11.96% on a real estate transaction in 6 months as private investors for real estate loans!

Which makes more CENTS $$$$$???

Now knowing that investing in real estate will bring leaps and bounds MORE in return, know that ANYONE can be private investors for real estate loans!

WE HAVE A BETTER WAY: BE PRIVATE INVESTORS FOR REAL ESTATE LOANS!

info@reelpropertysolutionsllc.com or 507-218-8788